Tech stocks are no longer the subject of polite conversation. To some, stocks and bonds in general are passé. The hot topic today is real estate, residential that is. Over the past decade many home buyers who plunked down a modest down payment, seeking only a place of residence, have watched as their equity has grown exponentially to become the largest component of their net worth.

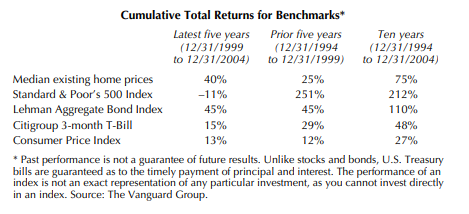

Some investor/homeowners might need a sobriety check. The table below demonstrates that the real run-up in home prices has been most pronounced during the past five years; however, relative to alternative investments, median (national) home-prices did not keep pace with either stocks or bonds over the past decade. Notably, even T-bills outperformed the median home price during the 1994–1999 period, and even after the tech-stock “melt-down” after 1999, stocks earned more than double the returns of the median home price in the ten years from 1994 to 2004.

A fair comparison between residential real estate and highly liquid financial assets is difficult. Median home prices exclude transaction costs, taxes, and operating costs such as insurance and maintenance, of which every homeowner is painfully aware. A homeowner with no financial assets but a fully paid-off mortgage might take comfort in “having a roof over his head,” but all of his eggs are in one basket. It is easy and inexpensive to diversify among a portfolio of stocks or bonds, but it is impractical to invest among several residential real estate markets (Real Estate Investment Trusts are highly liquid and a viable asset class, but these provide a stake in commercial properties, which differ distinctly from residential properties).

The point is investors should not look to their home equity as a substitute for a well-structured portfolio of financial assets. Especially dangerous is the practice known as “equity stripping,” or borrowing against ones home equity in order to invest in financial markets. A sharp downturn in the stock market coupled with an increase in interest rates could result in enormous losses for investors who go out on this limb.

Also in This Issue:

The Rent or Buy Decision

Small-Cap Stocks

The High-Yield Dow Investment Strategy

Recent Market Statistics

The Dow-Jones Industrials Ranked by Yield

To access the full article, please login or subscribe below.

Already a Subscriber?

Log in now

Subscribe Today

Get full access to the Investment Guide Monthly.

Print + Digital Subscription – $59/YearIncludes 12 Print and Digital Issues

Print + Digital Subscription – $108/2 Years

Includes 24 Print and Digital Issues

Digital Subscription – $49/Year

Includes 12 Issues

Digital Subscription – $98/2 Years

Includes 24 Issues